Nobody Knows How to Charge for AI

I've been watching the AI SaaS pricing chaos unfold over the past year, and honestly, it's fascinating how an entire industry can simultaneously agree that AI is transformative yet have absolutely no idea how to charge for it.

McKinsey dropped a report in September that tried to tackle this head-on. The Register, in their characteristically blunt fashion, responded with a piece titled "McKinsey wonders how to sell AI apps with no measurable benefits." Both are worth your time, and both highlight the same uncomfortable truth: we've built a lot of AI features, but we haven't figured out how to turn them into sustainable revenue.

The Numbers Don't Add Up

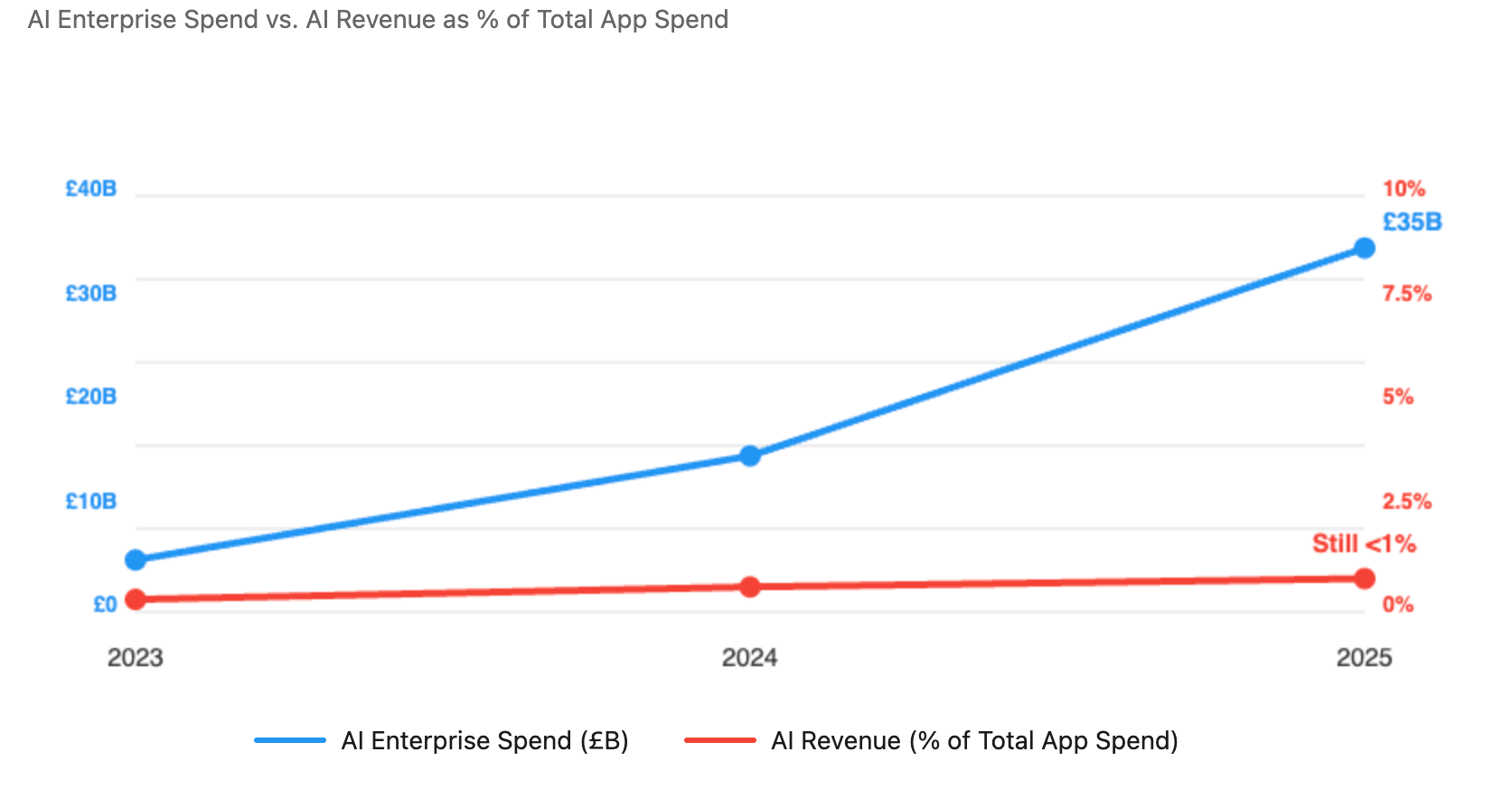

Here's what caught my attention. GitHub has 2 million paid Copilot users. Microsoft is touting AI success stories at every earnings call. The AI enterprise spend is growing like mad. Yet somehow, AI software revenues represent less than 1% of total application spend globally. That's not a rounding error, that's a fundamental disconnect.

The problem isn't that AI doesn't work. The problem is that no one can convincingly explain why you should pay for it, and when they can, they can't predict what it'll cost you next quarter.

Three Things Breaking the Model

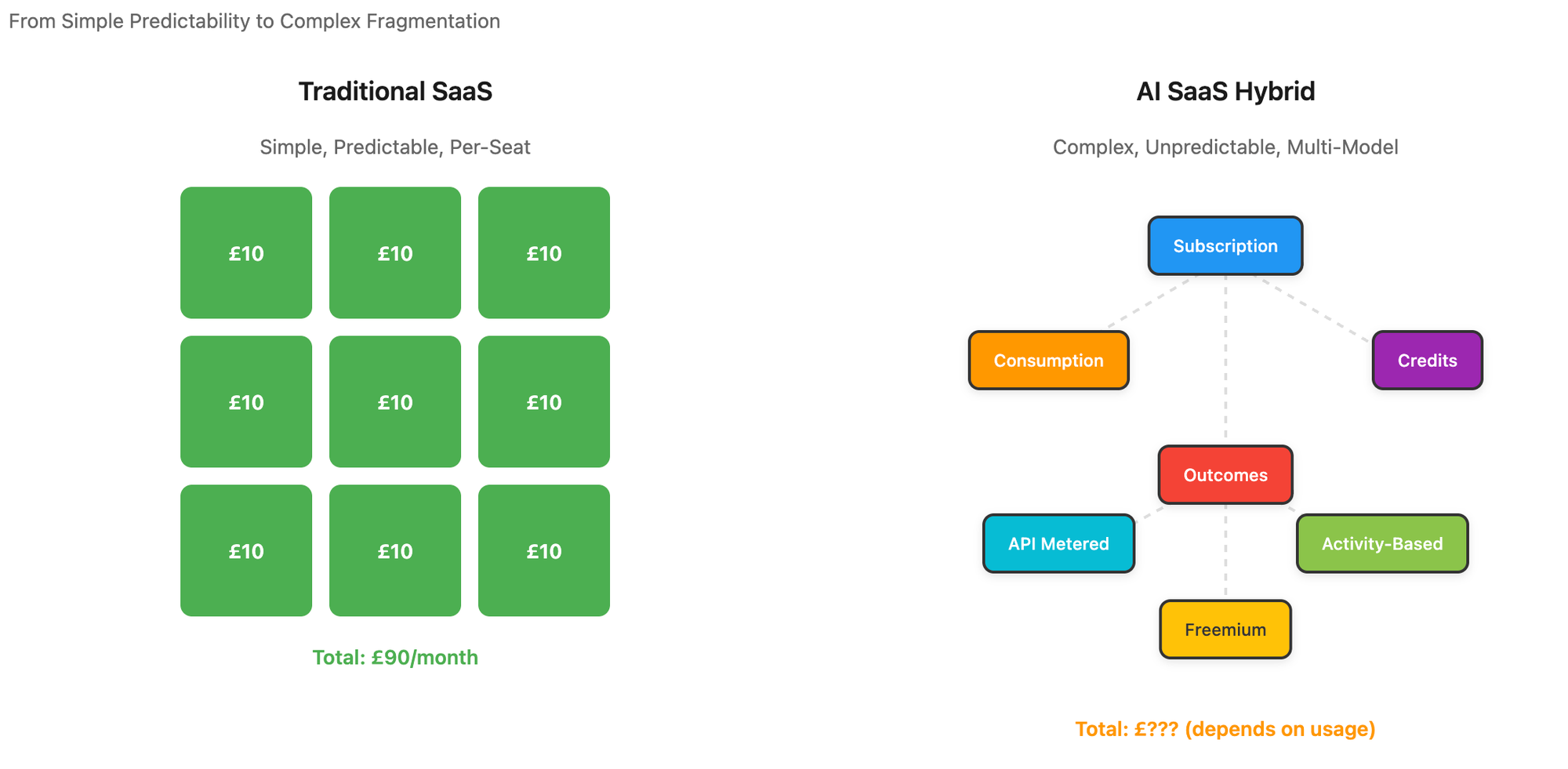

Let me break this down from first principles. Traditional SaaS worked because the value proposition was simple: you pay per seat, you get a set of features, and you can roughly predict what happens to your business. AI breaks all three parts of that equation.

⚠️ First, the value communication problem. McKinsey found that only 30% of AI sellers can actually quantify ROI on real customer deployments. Think about that. Seven out of ten people selling AI software can't tell you what it's worth. They'll wave their hands about productivity gains and efficiency improvements, but when you ask them to show you the numbers on actual deployments, they've got nothing.

The dirty secret here is that IT costs go up when you add AI. Your cloud bill increases. Your compute requirements spike. In theory, you offset this by reducing headcount. In practice, most enterprises can't actually cut people. The jobs change, sure, but the cost structure doesn't improve enough to make the CFO happy. And in markets with genuinely low-cost labour, the business case for automation often just doesn't close.

⚠️ Second, the pricing predictability nightmare. Cloud computing taught us that usage-based pricing can work, but cloud usage patterns are relatively stable and well-understood. AI consumption isn't. How many tokens will your team use next month? How many agent actions? How many model calls? No one knows, least of all your procurement team trying to forecast quarterly spend.

CFOs are used to uncertainty, but they're used to uncertainty they can model. AI usage doesn't follow historical patterns because the capabilities keep changing and the use cases keep expanding. That's uncomfortable at small scale and terrifying at enterprise scale.

⚠️ Third, the adoption scaling problem. This one surprised me when I first saw it, but it makes perfect sense once you think about it. For every pound you spend building and deploying AI models, you need to spend roughly three pounds on change management. Training. Process integration. Monitoring adoption. Hand-holding users through the transition.

Most AI pilots fail not because the technology doesn't work, but because organisations underinvest in the human side of deployment. The model works great in the demo, then sits unused because no one changed the workflow, no one trained the team, and no one monitored whether people actually adopted it.

How Pricing Models Are Evolving

The traditional per-seat subscription model is dying. It has to. You can't charge per seat for a Copilot that might save each seat a few hours a week, or might save them nothing at all depending on how they work.

What's emerging instead is a messy hybrid of subscriptions, consumption credits, and granular metered usage. Startups are experimenting faster than enterprises here, which makes sense. They've got less legacy pricing to defend and more flexibility to iterate.

The interesting shift is towards outcome-based and activity-based billing. Instead of charging per API call or per user, vendors are trying to bill for actual work completed. Tickets resolved. Leads generated. Workflows automated. This aligns incentives better but it's much harder to implement because you need to instrument the actual business outcomes, not just the API usage.

Some vendors are layering freemium models on top of this to capture different market segments and gather data on what pricing actually works. It's product-led growth meets AI, and honestly, most of them are making it up as they go along.

The Critical Perspective

The Register's take on all this is characteristically cynical but not wrong. They argue that AI monetisation is running well ahead of proven benefits, and many enterprises are paying for capability without seeing measurable returns. The vendors are hiking costs without delivering genuine productivity gains or actionable ROI.

That resonates with what I'm seeing in practice. There's a massive amount of AI theatre happening right now. Companies adding AI features because they feel they have to, not because they've figured out the value proposition. Then they're surprised when customers won't pay premium prices for those features.

What's Actually Happening in the Market

The buyer profile is shifting. Purchasing decisions increasingly sit with business leaders focused on outcomes, not IT buyers weighing feature lists. That's a fundamental change in how SaaS sales work, and most vendors haven't adjusted their go-to-market accordingly.

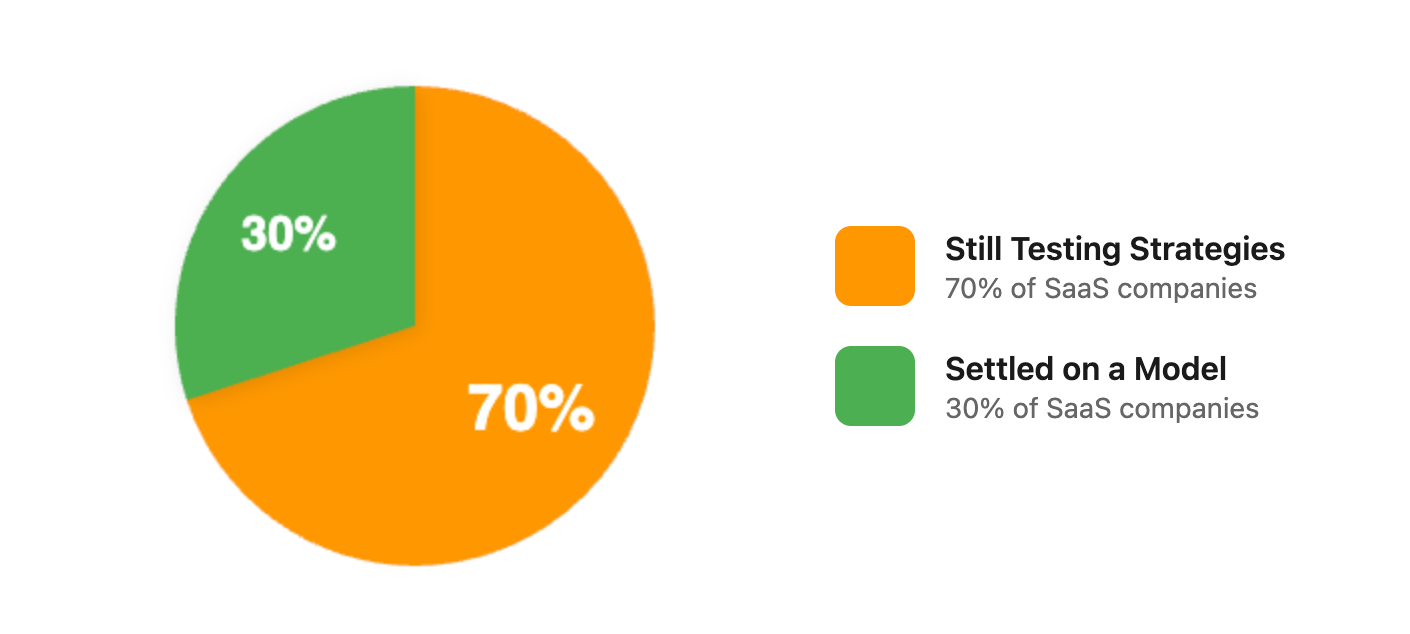

Nearly 70% of SaaS companies offering AI features are still actively testing new monetisation strategies. That's not a sign of innovation, that's a sign that no one knows what works yet. We're in a massive, industry-wide A/B test.

Nearly 7 in 10 companies are still experimenting. This isn't innovation, it's a sign no one knows what works yet.

The commoditisation pressure is real too. Basic AI capabilities are standardising fast. The "agentic" value proposition that felt cutting-edge six months ago is table stakes today. If your differentiation is just "we have AI now," you're not going to command premium pricing for long.

There's also an interesting shift in how data monetisation works in the AI era. Raw data resale is out. Intelligent action and outcome-based data products are in. Marketplaces for agentic orchestration and data-driven decisions are starting to emerge, but they're early and most will fail.

What This Means If You're Building or Buying

If you're a vendor, clear value realisation and predictable pricing aren't optional anymore. They're the price of entry. You need to be able to show actual ROI on actual deployments, with real numbers, to real customers. If you can't do that, you're selling hope, and hope doesn't renew contracts.

You also need to budget for change management as a first-class cost, not an afterthought. Your AI won't deliver value if no one uses it, and no one will use it if you don't invest in adoption. That's not a nice-to-have, it's the difference between a successful deployment and an expensive pilot that goes nowhere.

If you're a buyer, push hard on the ROI question. Don't accept hand-waving. Ask for customer references with real numbers. Ask how pricing will scale if your usage doubles. Ask what the change management plan looks like and who's accountable for adoption.

The Uncomfortable Truth

Here's the thing that most of these analyses dance around: maybe AI isn't actually worth what vendors are trying to charge for it yet. Not because the technology doesn't work, but because the incremental value over existing solutions isn't large enough to justify the incremental cost and complexity.

Some use cases have genuinely transformative ROI. Code generation for experienced developers. Certain types of customer support automation. Specific document processing workflows. But most use cases are marginal improvements dressed up as revolutions.

The monetisation mess isn't just a pricing problem. It's a value problem. The vendors who figure out how to deliver and demonstrate genuine, measurable value will win. Everyone else is just rearranging deck chairs.

The market will sort this out eventually. Some vendors will find sustainable models. Most won't. In the meantime, we're all learning what AI is actually worth by watching who's willing to pay for what.

No spam, no sharing to third party. Only you and me.

Member discussion