Most regulatory strategy documents are boring. Dense, safe, and full of nothing new. But the FCA's 2025–2030 strategy1 is different. It treats AI as a core tool to change how financial markets work, not just an add-on.

More importantly, it shows a real shift in thinking. Instead of avoiding all risk, they're talking about "rebalancing risk" to help growth and competition.

This won't trend on social media. But in 10 years, you might wish you'd paid attention.

Why This Matters

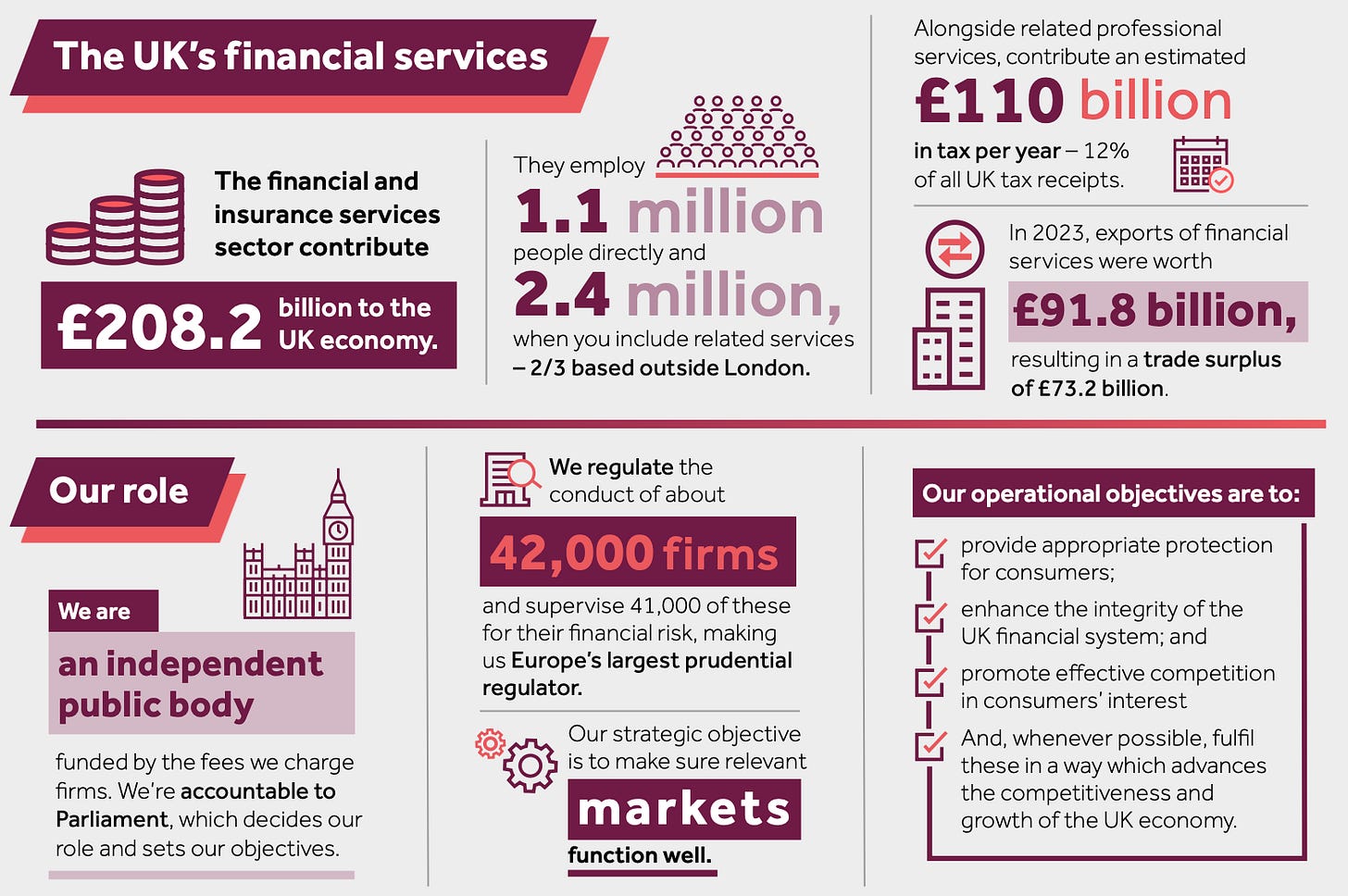

The FCA oversees a huge sector: £208 billion to the UK economy, 2.4 million jobs, and £91.8 billion in exports. Two-thirds of these workers are outside London.

How they handle AI in finance affects way more than just regulation. It shapes who gets funding, how productive companies can be, and whether the UK stays competitive.

The FCA Is Going Digital

They're committing to be a "smarter regulator" by:

Making authorization processes digital

Streamlining enforcement

Handling 100,000+ cases more efficiently

Training staff to use AI tools

When people don't trust institutions much, using AI to make regulation faster and clearer isn't just about efficiency. It's about staying credible.

Helping Innovation Happen

The FCA isn't just modernizing itself. It's actively helping firms innovate:

Over 200 companies have tested AI/ML with FCA support

Running tokenization experiments

Building a roadmap to Open Finance by 2027

Their approach? Focus on results, not rigid rules. Let companies innovate, and step in only when risks get too big.

This is smart AI regulation: create safe spaces to test, give clear guidance, and don't kill ideas before they can prove themselves.

The Big Shift

The most important part might be this quote:

"Regulation should be about enabling informed risk, not eliminating it entirely."

In a sector built on being careful, this is bold. It reframes regulators from blockers to enablers of smart risk-taking. That changes everything for AI in lending, investing, and payments.

Bottom Line

The FCA's strategy isn't flashy. But it's practical, understands tech, and isn't scared of AI. That's unusual for regulators.

If you're building in fintech, payments, or AI, read the full strategy. How today's regulators handle tomorrow's tools will shape what you can build.

https://www.fca.org.uk/publication/corporate/our-strategy-2025-30.pdf